Essential Financial Terminologies Explained

.jpeg)

Understanding Financial Terminologies

Financial terminologies are the building blocks of understanding the complex world of finance. Whether you're a seasoned investor or just starting out, having a grasp of these terms will help you navigate the financial landscape with confidence.

Key Financial Terms You Should Know

1. Asset

An asset is anything of value that can be converted into cash. This includes physical items like real estate and vehicles, as well as intangible items like stocks and bonds.

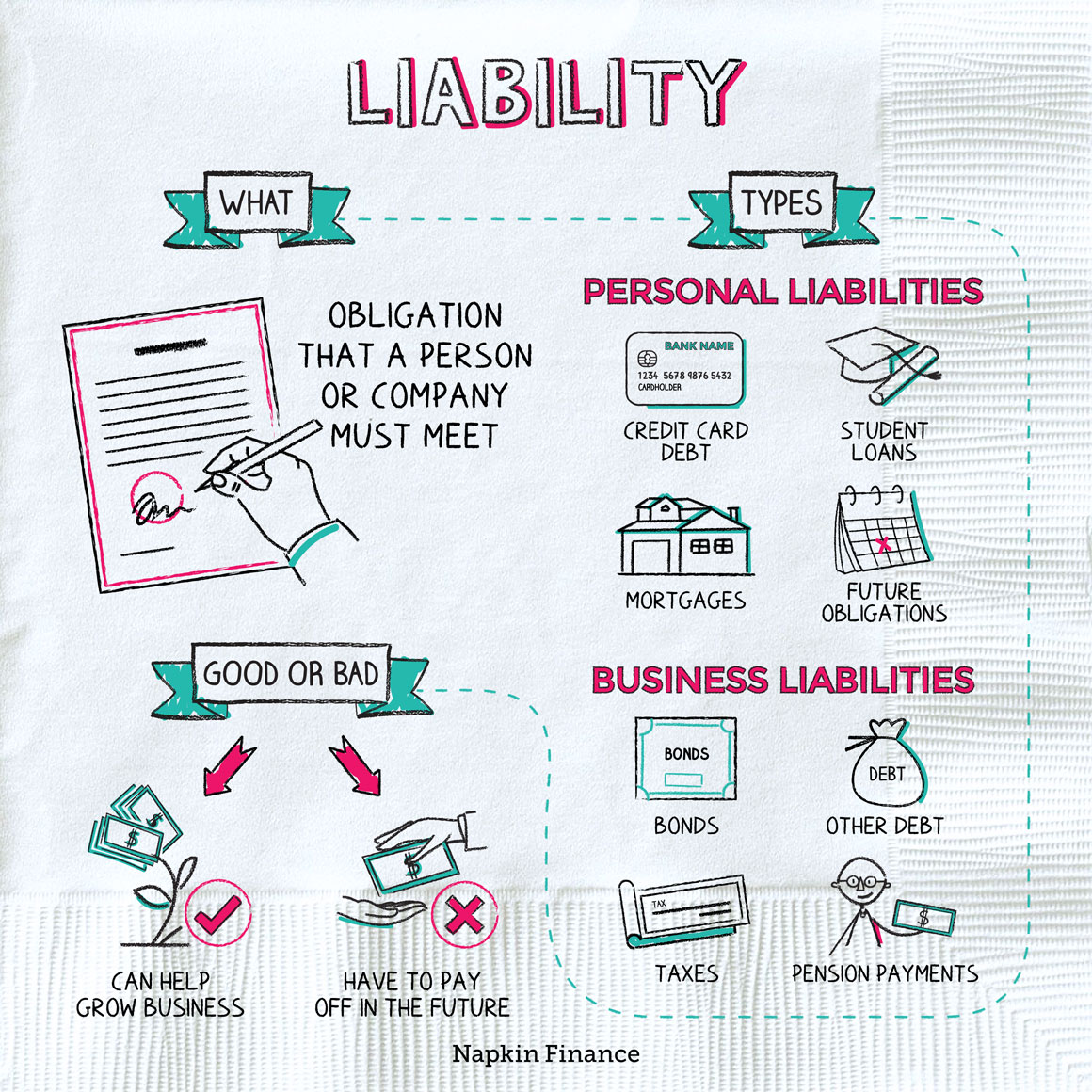

2. Liability

A liability is a financial obligation or debt that a company or individual owes to others. Examples include loans, mortgages, and accounts payable.

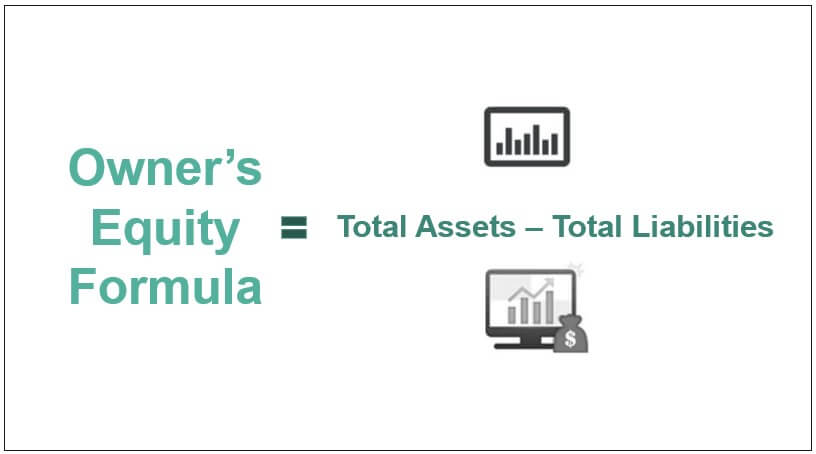

3. Equity

Equity represents the ownership interest in a company, calculated as the difference between the total assets and total liabilities. It is often referred to as shareholder equity in the context of companies.

4. Revenue

:max_bytes(150000):strip_icc()/Revenue-c58225e21ce34fcbb6e072f36e977e37.jpg)

Revenue is the total amount of money generated by a company from its business activities, usually from the sale of goods and services. It is often called the top line because it appears at the top of the income statement.

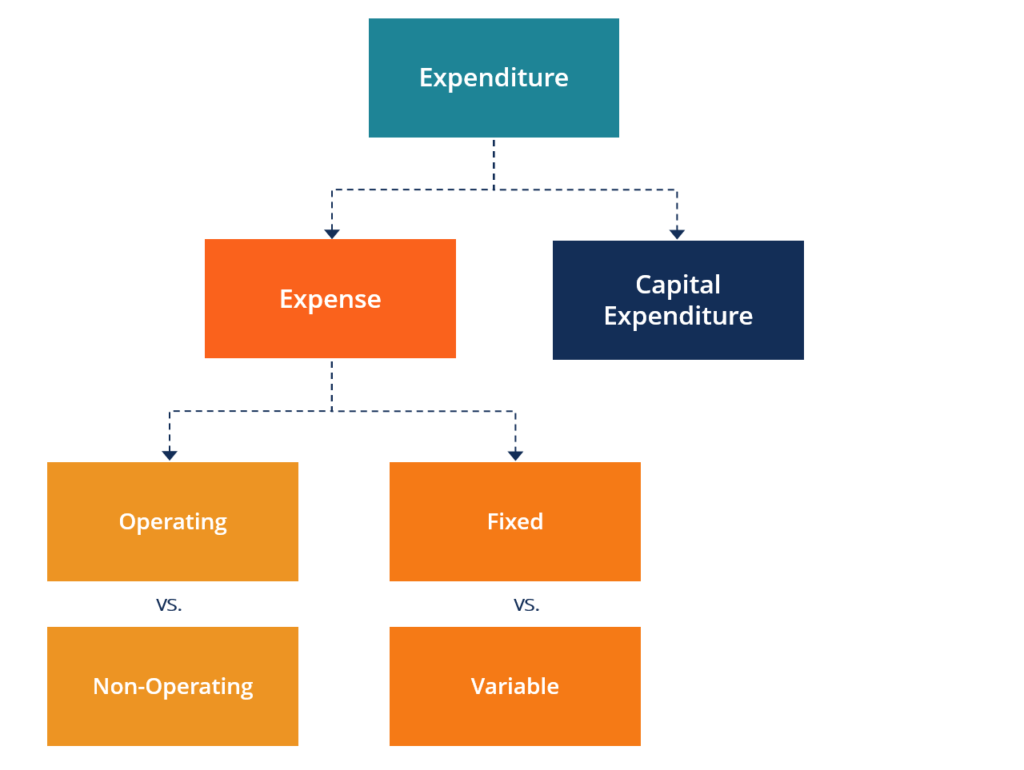

5. Expense

An expense is the cost incurred by a business in the process of earning revenue. Common expenses include rent, salaries, utilities, and cost of goods sold (COGS).

6. Profit

:max_bytes(150000):strip_icc()/Profit_Final_4190832-b5bc74e8d44046349ff5691a77d7c1ba.jpg)

Profit, also known as net income, is the amount of money left over after all expenses have been deducted from revenue. It is a key indicator of a company's financial health.

7. Cash Flow

Cash flow refers to the net amount of cash being transferred into and out of a business. Positive cash flow indicates that a company is generating more cash than it is spending, while negative cash flow indicates the opposite.

8. Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It includes assets, liabilities, and equity.

9. Income Statement

An income statement, also known as a profit and loss statement, shows a company's revenues and expenses over a period of time, culminating in net income or loss.

10. Dividend

:max_bytes(150000):strip_icc()/Dividend-44d29cb374a34b1391ec3d48b08ecab6.jpg)

A dividend is a distribution of a portion of a company's earnings to its shareholders, usually in the form of cash or additional shares.

Conclusion

Understanding these fundamental financial terms is essential for making informed decisions and successfully managing personal and business finances. As you become more familiar with these concepts, you'll be better equipped to navigate the financial world and achieve your financial goals.

Continue to expand your financial vocabulary and deepen your knowledge to stay ahead in the ever-evolving financial landscape. Happy learning!