5 Rules to Improve Your Financial Health

.jpeg)

Introduction

Maintaining good financial health is essential for a secure and stress-free life. Here are five crucial rules to help you improve your financial well-being and achieve your financial goals.

1. Create and Stick to a Budget

A budget is a financial plan that outlines your income and expenses. It helps you track where your money is going and ensures that you're living within your means. By creating and sticking to a budget, you can save more and avoid unnecessary debt.

2. Build an Emergency Fund

An emergency fund is a savings account set aside for unexpected expenses, such as medical bills or car repairs. Aim to save at least three to six months' worth of living expenses. Having an emergency fund provides financial security and prevents you from relying on credit cards or loans during emergencies.

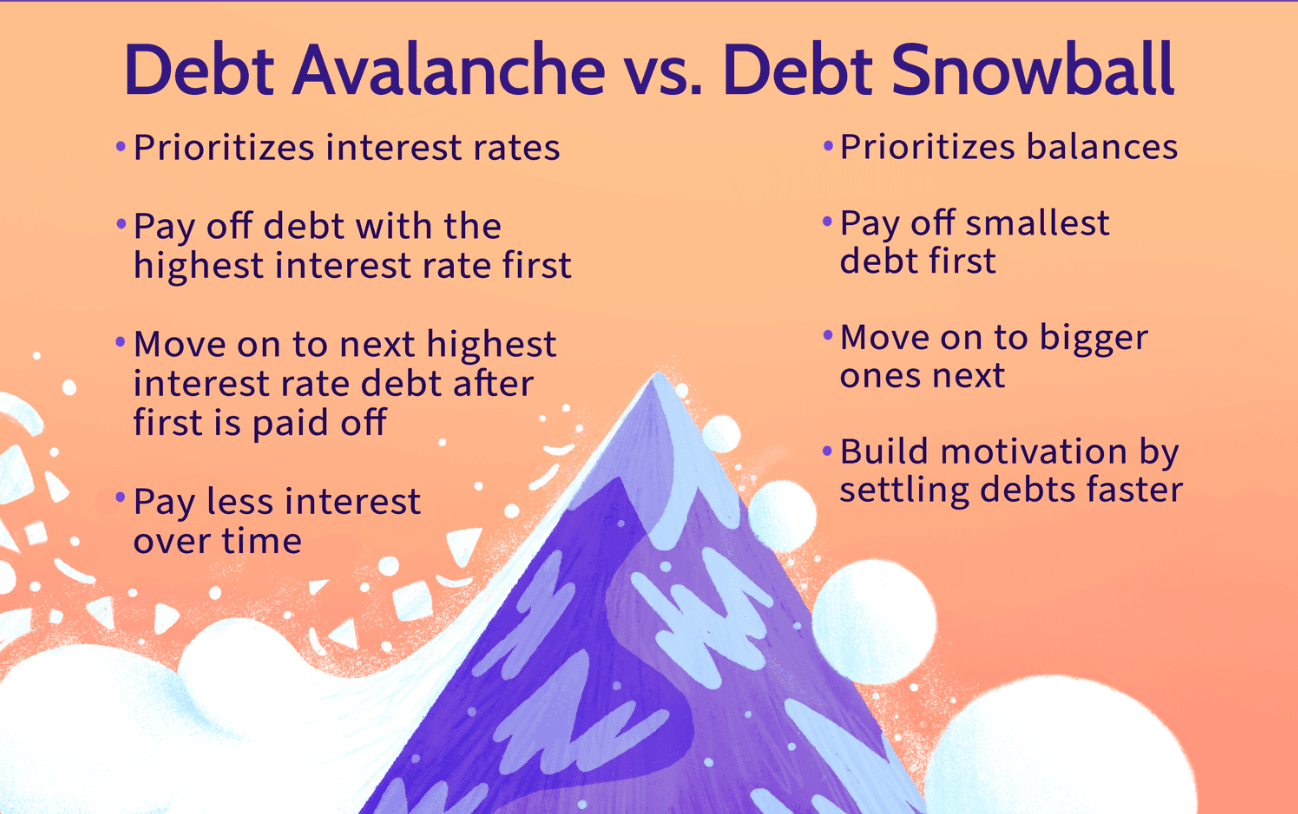

3. Pay Off Debt

High-interest debt, such as credit card debt, can hinder your financial progress. Focus on paying off your debts as quickly as possible. Start with the debt with the highest interest rate and work your way down. Reducing debt improves your credit score and frees up money for savings and investments.

4. Invest for the Future

Investing is a powerful way to grow your wealth over time. Consider investing in a diversified portfolio of stocks, bonds, and other assets that align with your risk tolerance and financial goals. The earlier you start investing, the more time your money has to grow through compound interest.

5. Continuously Educate Yourself

Financial literacy is crucial for making informed decisions about your money. Continuously educate yourself about personal finance, investing, and money management. Read books, take online courses, and follow reputable financial news sources to stay informed and improve your financial skills.

Conclusion

Improving your financial health requires discipline, planning, and continuous learning. By following these five rules, you can take control of your finances, reduce stress, and build a secure financial future.

Start implementing these strategies today and watch your financial health improve over time. Remember, consistency is key to achieving long-term financial success.